FM Nirmala Sitharaman sets Rs 15 lakh income cap to tax NRIs

New Delhi: Finance minister Sitharaman softened the contentious budget proposal to tax non-resident Indians, putting in place a threshold of Rs 15 lakh for the levy of tax on incomes emanating from India, while leaving out global incomes from the tax ambit.

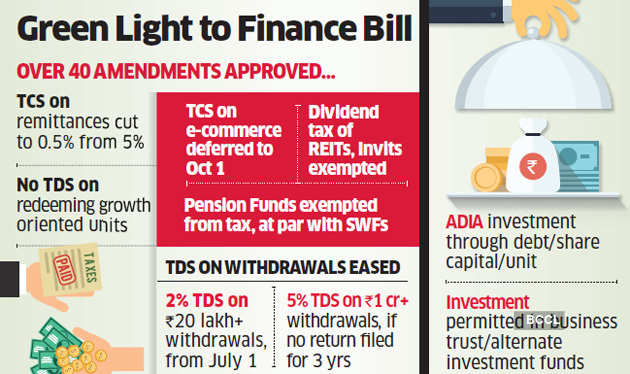

Through amendments to the finance bill, she provided a carve-out for REITs and InvITs in respect of changes in the taxation of dividends announced in the budget. Non-resident ecommerce firms will face a 2% equalisation levy or the so-called Google Tax.

Sitharaman also raised special additional excise duty on petrol and diesel in the latest changes introduced as amendments to the Finance Bill, which was passed without any discussion amid vociferous demands from opposition for a fiscal stimulus to tackle the economic impact of Covid-19.

‘Equalisation Levy a Dampener’

The bill was later returned by the Rajya Sabha, completing the process of budget passage by Parliament.

“Whilst all of these provisions are welcome, we had a dampener in the form of equalisation levy on ecommerce transactions being introduced on players who do not have a permanent establishment in India,” said Dinesh Kanabar, CEO, Dhruva Advisors LLP.

The levy will now cover companies such as AirBnB, Uber & several ecommerce delivery platforms that do not have a permanent establishment.

The current rate of the equalisation levy, introduced in 2016, is 6%.

“This will impact the non-resident ecommerce operators which were currently not paying any taxes,” said Amit Maheswari, partner, Ashok Maheshwary & Associates LLP.

Maheshwari said this is another step to tax operations of the non-resident ecommerce companies that were earlier in the net for facilitating import of goods as gifts, resulting in evasion of customs duty.

The government had proposed to tax global income of NRIs who are not taxed in any jurisdiction, but later clarified that only incomes of NRIs derived from doing business in India or undertaking a profession in the country will be taxed. This was by way of an anti-abuse provision against non-residents who don’t stay long enough in any tax jurisdiction to qualify as a resident and thus avoid being taxed. The government has now amended the budget provision to tax only those Indian citizens who have stayed in the country for a period of 120 days or more and had total income, other than from foreign sources, exceeding Rs 15 lakh in the previous year.

“The liability to pay tax on such deemed resident will be only in respect of business controlled in India or profession set up in India and that too when such income exceeds the threshold of Rs 15 lakh,” said Rakesh Nangia, chairman, Nangia Andersen Consulting. Further, such persons have been categorised as ‘not ordinarily resident’ if they reside in India for 120 days or more but less than 182 days.

‘WELCOME MOVE’

“The relaxation is welcome. However, the threshold seems to be on the lower side to benefit the community at large,” said Amit Singhania, partner at law firm Shardul Amarchand Mangaldas.

Further, the tax deducted at source (TDS) rate on payment of dividend to non-resident and foreign company has been set at 20%.

The amendment to raise special additional excise duty on petrol and diesel was also approved. The cap on special additional excise duty for petrol has been increased to Rs 18 from the present level of Rs 10 per litre, and that on diesel has been raised to Rs 12 from Rs 4 per litre.

The increase will allow the government to raise taxes on fuels and use the crash in global fuel prices to generate revenue.

The finance minister stood firm on the new optional system of income tax slabs for individual taxpayers that offer lower rates without deductions and exemptions.

The house also passed the proposal to levy tax collected at source (TCS) on sale of goods. However, exports and sale to sellers for imports have been exempted. The change will be effective October 1, 2020, giving ecommerce players adequate time to get their systems in place for execution.

TCS of 5% on foreign remittances will also be applicable from October 1, 2020, instead of the earlier date of April 1.

The proposal for taxing dividends in the hands of shareholders by abolishing the dividend distribution tax (DDT) was also passed. While the new rule kicks in from April 1, 2020, the government has clarified that shareholders will have no tax liability if the company issuing the dividend has paid the DDT before April 1.